Form 1098-T Information

The 1098-T form is used by eligible educational institutions to report information about their students to the IRS as required by the Taxpayer Relief Act of 1997. Eligible educational institutions are required to submit the student's name, address, and taxpayer’s identification number (TIN), enrollment and academic status. Beginning with 2003, educational institutions must also report amounts to the IRS pertaining to qualified tuition and related expenses, as well as scholarships and/or grants, taxable or not. A 1098-T form must also be provided to each applicable student. This form is informational only. It serves to alert students that they may be eligible for federal income tax education credits. It should not be considered as tax opinion or advice. While it is a good starting point, the 1098-T, as designed and regulated by the IRS, does not contain all of the information needed to claim a tax credit. There is no IRS requirement that you must claim the tuition and fees deduction or an education credit. Claiming education tax benefits is a voluntary decision for those who may qualify.

To access your 1098-T tax form:

Form 1098-T Tuition Tax Statements will be available to students on January 31st. Students can log in to Self-Service as soon as possible and consent to view the form online via the Tax Information section of Self-Service. If no consent is received, a paper version of the form will be sent via postal mail.

- Log in to Self-Service

- Select Tax Information

- Select Electronic Format or Paper Format 1098-T Statements

If electronic consent is given, statements are listed for viewing or printing.

1098-T FAQs

The 1098-T is used to report information to the IRS as required by the Taxpayer Relief Act of 1997. Eligible educational institutions are required to submit the student’s name, address and taxpayer identification number, enrollment and academic status, amounts pertaining to qualified tuition, related expenses, and scholarships and/or grants, taxable or not. This form is for informational purposes only. While it is a good starting point, the 1098-T, as designed and regulated by the IRS, does not contain all the information needed to claim a tax credit.

The IRS is now requiring colleges and universities, starting with the 2018 tax year, to report in Box 1 (payments received). Previously, Southwest Texas Junior College was reporting in Box 2 for amounts billed.

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

Southwest Texas Junior College is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

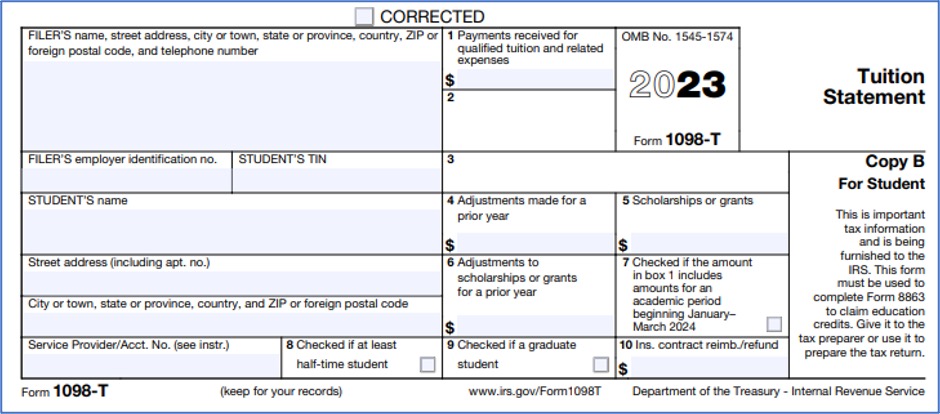

Below is a blank sample of the 2023 Form 1098-T, that you will receive in January 2024, for your general reference. For more information about Form 1098-T, visit https://www.irs.gov/forms-pubs/about-form-1098-t.

The IRS does not require us to generate a 1098t form for the following:

- International students (unless requested with SSN and/or TIN on file)

- Students enrolled in non-degree programs

- Students who did not have payments for qualified tuition and related expenses

- Box 1- Payments Received for Qualified Tuition and Related Expenses. The amount reported is the total amount of payments received less any reimbursements or refunds made during the calendar year. The amount reported is not reduced by scholarships and grants reported in box 5.

-

- Payments received in the prior calendar year will not appear in Box 1 even if the semester started in the 2020 calendar year.

- Box 1 may be reduced by amounts billed in the previous calendar year for semesters starting in the 2020 calendar year.

- To review all payments and other credits applied to your account during the year, please log into your Self-Service account. Under the Student Finance heading select Account Activity.

- Box 2- Starting with the 2019 tax year, this box will now be blank.

- Box 3- This box will be checked since Southwest Texas Junior College did change its method of reporting for the calendar year.

- Box 4- The amount of any adjustments made to qualified tuition and related expenses reported on a prior year Form 1098-T. This amount may reduce any allowable education credits students may claim for the prior year. See IRS Form 8863 or IRS Publication 970 for more information.

- Box 5- The total amount of scholarships or grants paid and processed by Southwest Texas Junior College during the calendar year. This may also include scholarships and grants posted in the reporting year for a prior year.

- Box 6- The amount of any adjustments made for prior year scholarships or grants. This amount may affect the amount of any allowable tuition and fees deduction or education credit students may claim for the prior year. See IRS Form 8863 or IRS Publication 970 for more information.

- Box 7- If checked indicates that the amount reported in Box 1 includes amounts paid for an academic period beginning in the next calendar year. (for example, payments made in December 2020 for terms beginning January – March 2021) See IRS Publication 970 for more information.

- Box 8- Indicates whether students are considered to be carrying at least one-half the normal full-time workload for their course of study at Southwest Texas Junior College.

- Box 9- Indicates whether a student is considered a graduate student.

- Box 10 - This box will be blank.

Qualified tuition and related expenses include undergraduate and graduate tuition, and student activity fees. The cost of course-related books and supplies, may qualify in certain circumstances.

Expenses that do not qualify include room and board, insurance, medical expenses, and various fees and charges.

See IRS Form 8863 or IRS Publication 970 for more information.

Students can see the activity on their student account by logging into Self-Service, going to Student Finance, and clicking on the Account Activity link.

Southwest Texas Junior College cannot provide tax advice. Individuals should consult their tax professional to find out more about their eligibility for tax credits and/or the taxability of your scholarships. Information also may be obtained at the Internal Revenue Service website.

Our federal identification number is 74-6002420. It is included on all tax documents produced by the College (W-2, 1098-T, etc.).

I still have questions who can I contact?

Southwest Texas Junior College has provided the Form 1098-T in compliance with IRS guidelines. However, SWTJC is unable to answer any tax-related questions or provide any tax advice on this issue.

All information and assistance that SWTJC can provide is contained in this notice. The content of this notice is not intended as legal or tax advice.

For tax specific questions, please contact the Internal Revenue Service (IRS) at 1(800) 829-1040 or your personal tax advisor for further assistance.